If rising memory prices already feel frustrating, storage could soon become the next hardware category to squeeze budgets. New industry reports suggest that flash storage prices may continue climbing throughout 2026 as major manufacturers pull back production, even while demand keeps accelerating.

According to reporting from Chosun Biz, two of the world’s largest flash memory producers, Samsung Electronics and SK hynix, are preparing to cut NAND flash output this year. The move comes at a time when storage demand is rising sharply, driven largely by artificial intelligence workloads and expanding data center infrastructure.

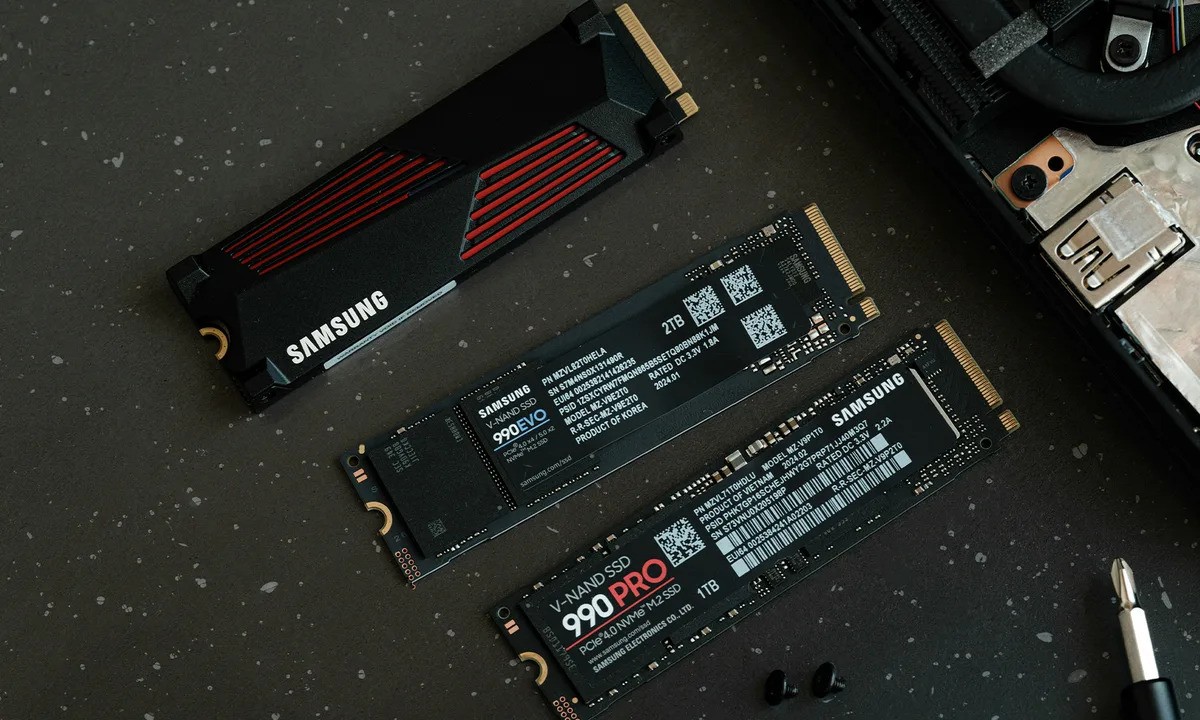

That combination of tightening supply and growing demand has raised concerns across the PC and consumer electronics markets. Solid state drive prices have already been trending upward, and further NAND reductions could push costs higher across laptops, desktops, and enterprise systems.

NAND flash is a foundational component used in SSDs, USB flash drives, smartphones, tablets, and a wide range of enterprise storage hardware. When production slows, the effects tend to ripple quickly across the entire ecosystem. Analysts warn that the long period of falling SSD prices may be coming to an end, reversing years of steady affordability gains for consumers.

Why NAND production cuts matter

At the center of the issue is how memory manufacturers are reallocating their resources. Samsung and SK hynix together control well over half of global NAND production, which gives their output decisions significant influence over the market.

Industry estimates indicate Samsung is planning to reduce NAND output by roughly 4.5 percent, while SK hynix could scale back production by more than 10 percent. Rather than signaling weak demand, the cuts appear to be a strategic shift. Both companies are focusing more heavily on higher margin products such as DRAM and high bandwidth memory, which are in strong demand for AI accelerators and cloud computing platforms.

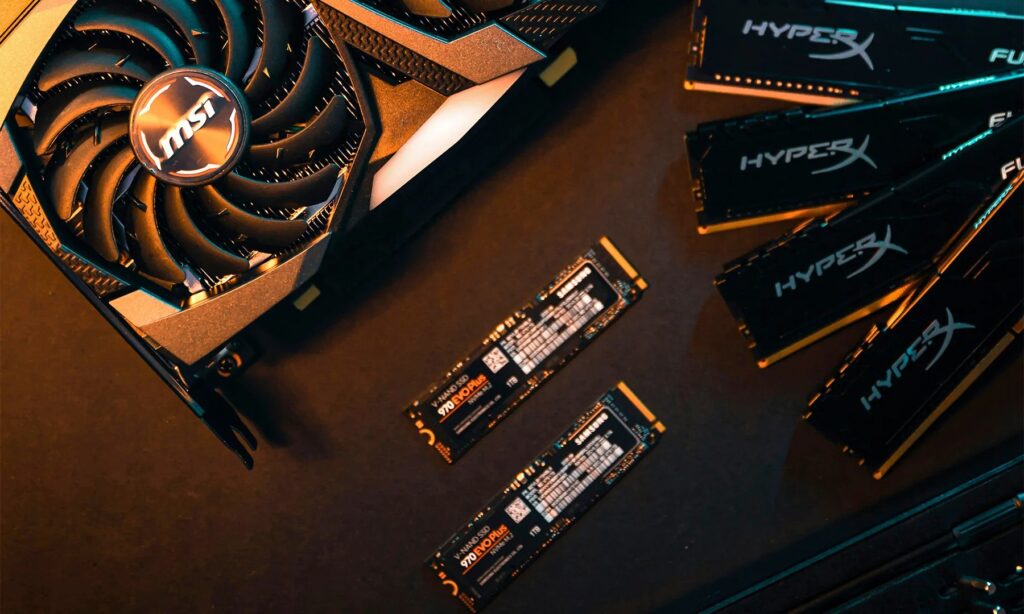

This pivot matters because fewer NAND chips directly translate into fewer solid state drives entering the market. As AI models grow larger and data platforms consume massive amounts of storage, traditional consumer devices are increasingly competing with enterprise customers for limited supply.

The result is a pricing environment that favors manufacturers, not buyers. SSDs that once felt like clear value upgrades over mechanical hard drives could become noticeably more expensive, regardless of capacity or form factor, if NAND availability remains constrained.

Storage prices and the broader PC market

For PC builders and everyday buyers, the timing is far from ideal. Storage is no longer the only component under pressure. Memory prices have already climbed over the past year, and adding higher SSD costs into the mix raises the total price of new systems and upgrades.

Consumers who delayed purchases in hopes of better deals may find fewer bargains ahead, especially on higher capacity NVMe drives. The impact could be particularly noticeable for gaming PCs, creator workstations, and laptops where fast storage is now a baseline expectation rather than a premium feature.

Some buyers may begin rethinking upgrade paths altogether, choosing to reuse existing drives or settle for lower capacities to stay within budget. In an environment where both RAM and storage costs are moving in the same direction, the overall value equation for new hardware looks increasingly different from just a year ago.

As AI continues reshaping how memory manufacturers prioritize production, the consumer storage market is entering a phase where supply dynamics, not just technological improvements, will play a much larger role in what buyers ultimately pay.