Asus may be exploring unusually bold options as the ongoing global memory shortage continues to push laptop prices higher. Although the company has publicly stated that it has no immediate plans to launch its own RAM production, industry chatter suggests the Taiwanese hardware giant could still be evaluating the idea of producing its own DRAM as early as 2026. The motivation is simple: reduce dependence on the handful of memory manufacturers that currently dominate the market.

The core issue stems from a major shift in priorities among the world’s largest memory suppliers. Companies such as Samsung, Micron, and SK Hynix are pouring resources into AI-focused data center hardware, where profit margins are significantly higher. As a result, production of consumer-focused DDR4 and DDR5 memory has taken a back seat. With supply tightening and demand holding steady, memory prices have surged across the board.

For PC manufacturers, the impact is becoming increasingly difficult to absorb.

Alongside brands like Dell and Framework, Asus has already been preparing for laptop price increases in order to offset rising component costs. The challenge is that even companies operating at Asus’s scale have limited negotiating power when suppliers are prioritizing massive enterprise contracts over consumer hardware.

Reports from the Persian tech publication Sakhtafzarmag, later referenced by Wccftech, suggest Asus is at least discussing the possibility of entering the DRAM manufacturing space in 2026. If that move were to materialize, it would represent a significant departure from Asus’s traditional role. While the company has extensive experience designing and assembling hardware, memory chips themselves have always been sourced from external suppliers.

The stakes for Asus are high.

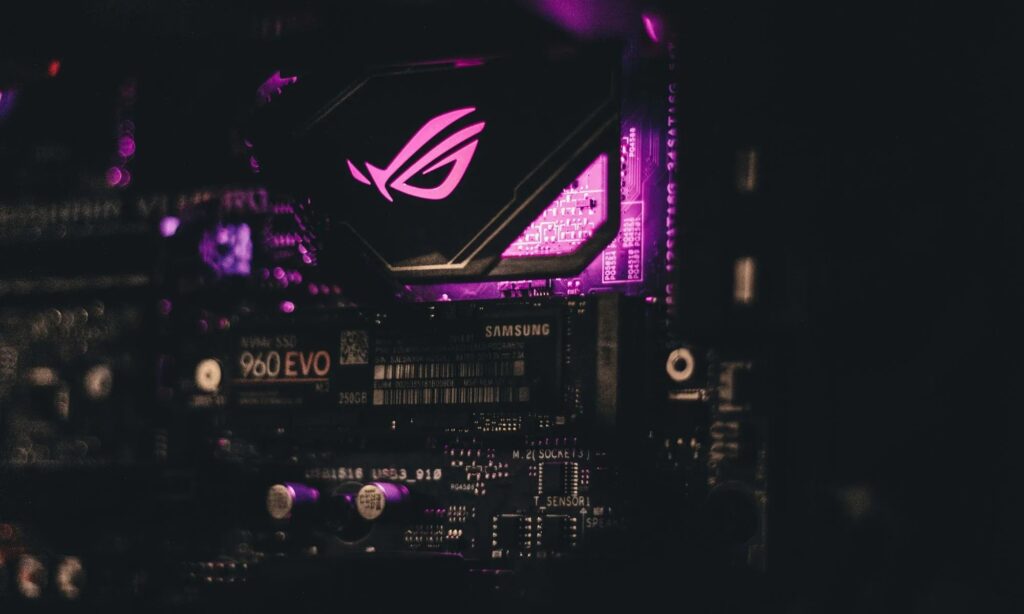

The company’s product lineup spans everything from high-performance ROG gaming laptops to graphics cards, motherboards, and other PC components, all of which rely heavily on system memory or VRAM. With costs continuing to climb, even small disruptions in supply can ripple across entire product categories.

That said, skepticism around the idea remains strong. DRAM manufacturing is notoriously expensive and technically complex, requiring years of expertise and massive upfront investment. The current market leaders have decades of experience and established supply chains that would be difficult to match. Even if Asus were to build its own fabrication facilities, it may still need to source foundational components from existing players, limiting any short-term relief on pricing.

Another path under consideration could involve diversifying partnerships rather than building everything in-house. A lesser-known Chinese manufacturer, CMXT, recently attracted attention after unveiling its own LPDDR5X and DDR5 memory products. While this introduces some level of competition, the company faces capacity constraints along with ongoing U.S. trade restrictions that complicate global distribution.

For consumers planning to buy a new laptop, the outlook remains uncertain. Elevated prices appear unavoidable in the near term, and SK Hynix has already indicated that memory supply pressures could persist until at least 2028. Whether Asus ultimately pursues in-house production or continues to absorb higher costs from suppliers, the next few years are shaping up to be turbulent for the PC market.