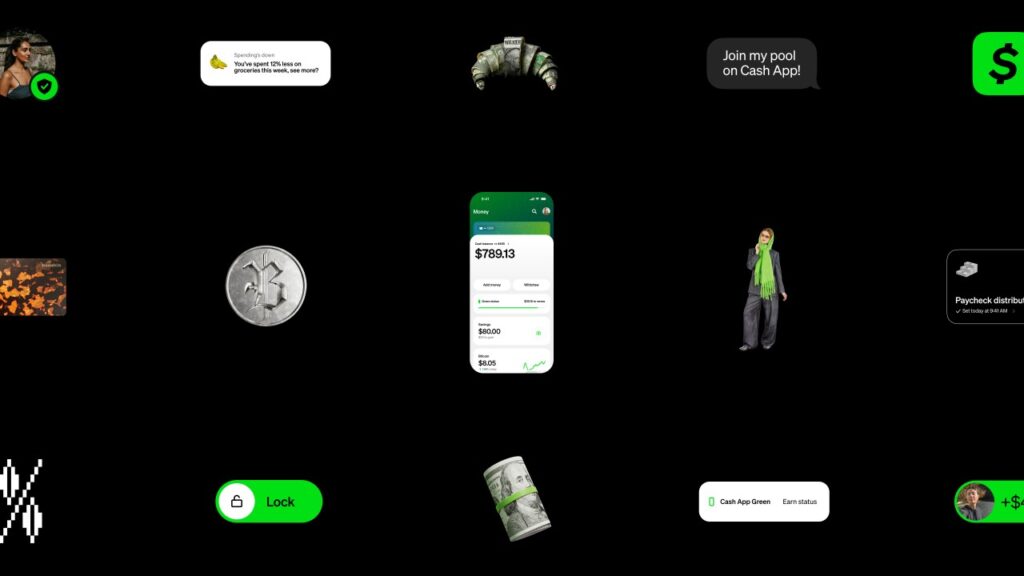

Cash App has rolled out a fresh wave of product upgrades for its fall release, placing a major spotlight on its new AI financial assistant, Moneybot. The tool is designed to help users make better sense of their spending, income and overall money habits, giving the app a more proactive role in day-to-day financial decisions.

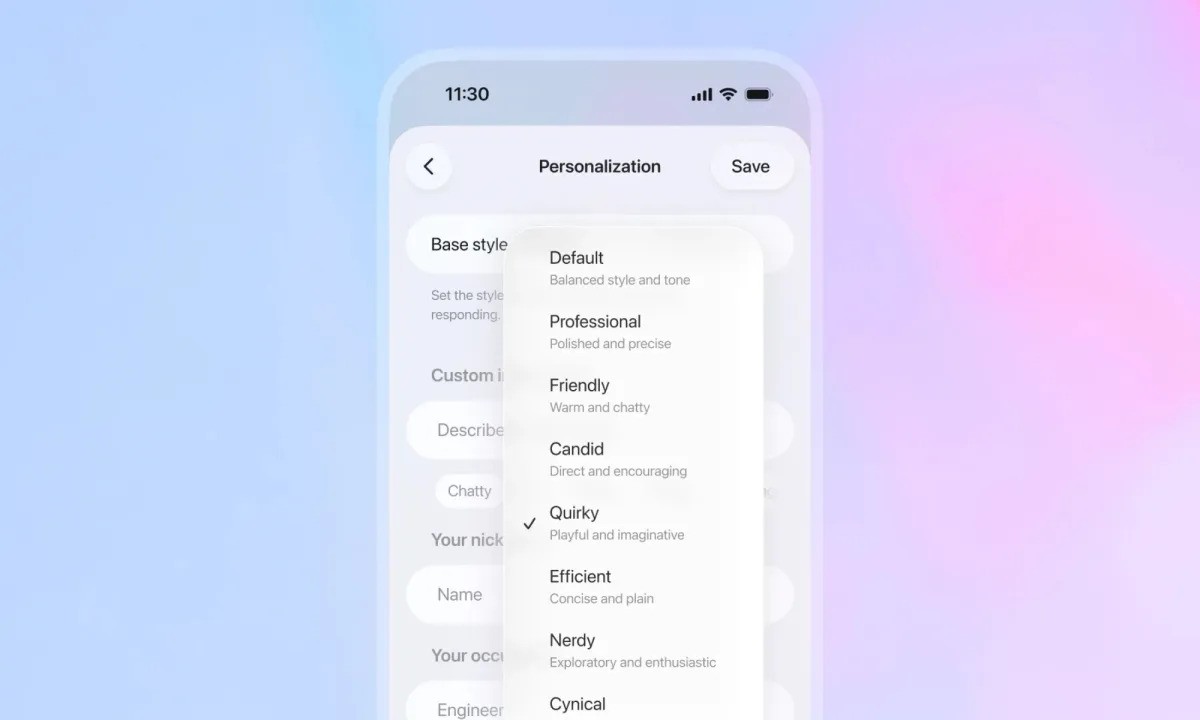

Moneybot uses Cash App’s existing account data to create personalized guidance. Instead of simply showing raw numbers, the assistant can respond to natural language prompts like “Show me my monthly income and expenses” or “How much did I spend eating out last week,” turning historically passive financial information into actionable insights. According to Cash App, the AI assistant will initially launch to select users, with plans for a broader rollout soon.

Along with answering questions, Moneybot also recommends steps users might want to take, such as sending a payment request, checking Bitcoin balances, splitting a bill, or adjusting savings goals. The company says the assistant adapts to each user’s patterns in real time so that recommendations feel more relevant the longer someone uses the feature.

Cameron Worboys, Cash App’s head of product design, noted that consumers today are surrounded by financial data but rarely get help understanding how to act on it. Moneybot aims to reduce that gap by turning routine account activity into insights that support more informed money management. For those following the evolution of consumer fintech, this aligns with broader industry trends highlighted by firms like a16z, McKinsey, which point to personalized finance as one of the fastest growing AI categories.

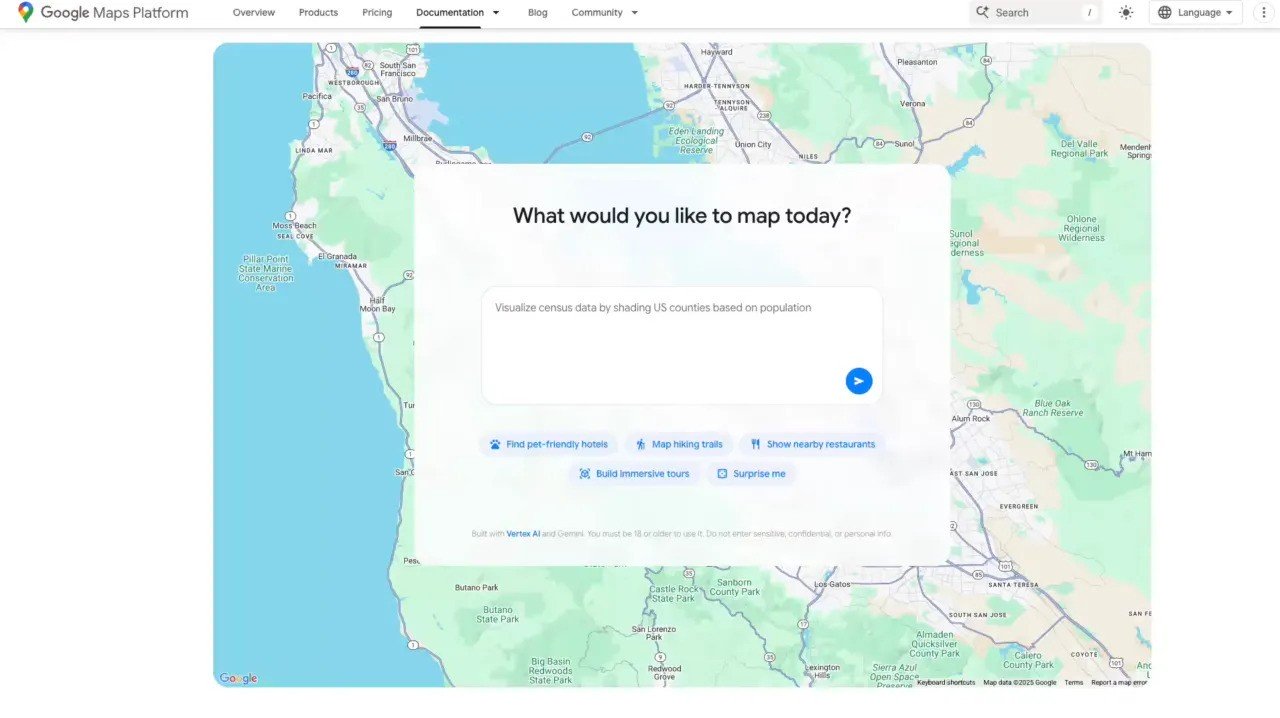

Cash App’s parent company, Block, has also accelerated its push into Bitcoin utility. Last month, the company introduced a Bitcoin payment solution for merchants that automatically deposits funds into a wallet. Now, Cash App users can discover businesses that accept Bitcoin through an integrated map and even pay in Bitcoin using USD without actually holding any cryptocurrency. The transactions run on the Lightning Network, a layer two protocol on top of Bitcoin that enables faster, low cost payments through QR codes. For users unfamiliar with Lightning, resources like lightning network provide a deeper breakdown of how it works.

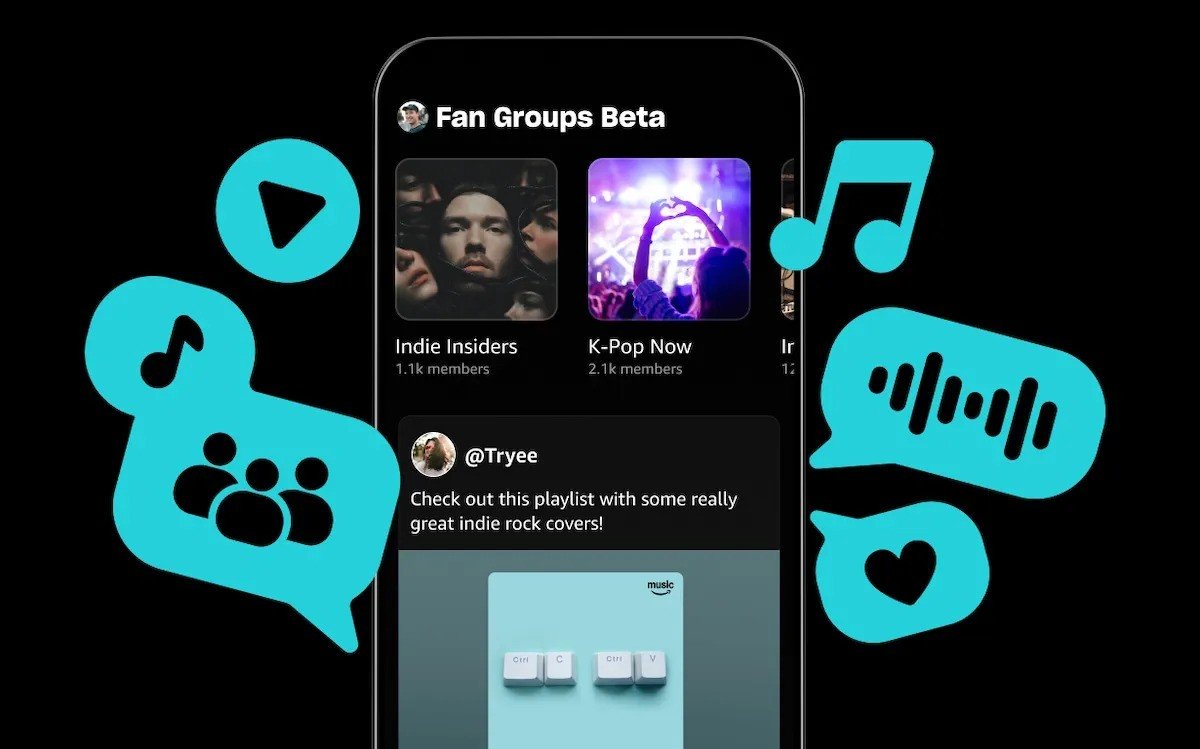

The company confirmed it plans to add support for sending and receiving stablecoins to certain users soon, further expanding its crypto-friendly ecosystem.

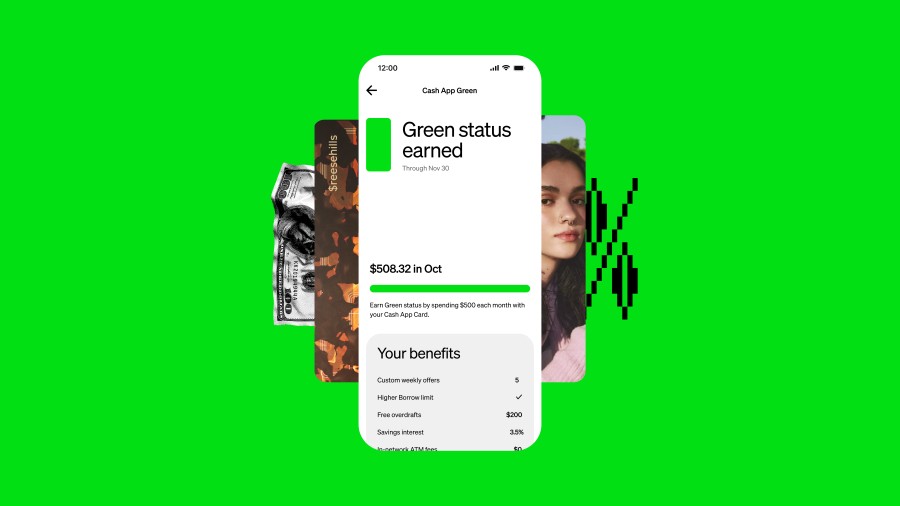

Cash App is also restructuring how customers qualify for perks. Previously, users needed at least 300 dollars in monthly direct deposits to unlock benefits such as a 3.5 percent yield. Under the newly introduced Cash App Green program, users can earn perks by either spending 500 dollars or more each month through Cash App Pay or the Cash App Card, or by receiving monthly deposits of at least 300 dollars. Block estimates that up to 8 million accounts will qualify based on the new criteria.

These benefits include a higher borrowing limit that starts at 400 dollars for new borrowers and can increase by up to 300 dollars for existing ones, free overdraft coverage up to 200 dollars for Cash App Card transactions, free in network ATM withdrawals, five rotating weekly offers and a savings yield of up to 3.5 percent APY. Teen users will receive the same APY without any balance limits.

Cash App is also widening access to its Borrow feature, which will now be available across 48 states, and it is integrating select Afterpay buy now pay later options directly into the app so users will not need a separate login.

As Cash App continues to evolve into a more comprehensive financial toolkit, these updates place the company in a stronger position within the competitive fintech landscape. The addition of an AI assistant, expanded crypto features and a revamped rewards model positions the platform as a more adaptive and user-focused alternative to traditional digital banking apps.